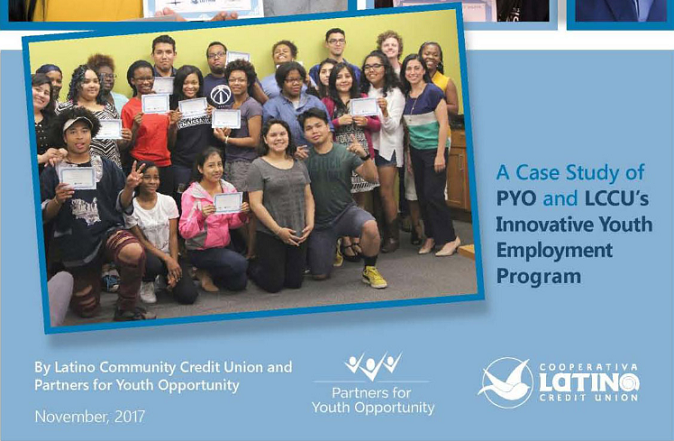

Today, at Partners for Youth Opportunity’s (PYO) annual Scholarship Party, Latino Community Credit Union (LCCU) and PYO released Building Financial Capability on the Road to Post Secondary Success: A Case Study of PYO and LCCU’s Innovative Youth Employment Program. The case study highlights the innovative strategies and promising outcomes of their Saving for the Future Program.

According to Julie Wells, PYO’s Executive Director, “the results of the first two years of our program make clear that our students are building their savings while developing the positive financial habits and behaviors they need to achieve their post-secondary goals. Just as importantly, they are developing a college-bound identity as they see that their post-secondary goals are within their reach.”

The Saving for the Future Program is a youth employment program with a focus on building financial capability developed by PYO and LCCU in 2015. The Program provides high-school age, PYO students with paid internships and uses the payroll system to connect them to accounts at LCCU. PYO students agree to direct at least 20% of their income to their saving account to be used for post-secondary education. To help PYO students develop a culture of long-term planning and saving, the Program asks them to set a $325-savings goal. When the PYO students meet their savings goal, they receive a $175 savings match and are able to open a higher interest yielding one-year CD.

Results from the Program first two cohorts are impressive:

- A majority of program graduates met their savings goals– 36 of 43 program graduates achieved their savings goals, received a $175 savings match, and opened a 1-year CD.

- Program graduates are building their savings- The 43 program graduates have saved a combined $39,369, an average of $916 per student. According to research published by University of Kansas and the Assets and Education Initiative, children who save up to $500 are three times more likely to attend college and four times more likely to graduate.

- Program graduates continue to build their financial capability. Forty two of the 43 program graduates have kept their LCCU account open and continue to use its many features regularly, a strong indicator that they are avoiding the costly informal financial sector.

LCCU CEO Luis Pastor expressed admiration for the PYO students. “These young savers are making one thing clear: if they have access to an ethical and empowering savings vehicle, they will work hard and build the savings they need to make their post-secondary dreams come true.”

The case study highlights a number of key factors that made the Saving for the Future Program a success and that other youth empowerment organizations can incorporate to their youth employment programs. Among others, these include:

- PYO and LCCU provide ongoing, personalized supports to ensure that PYO students’ entry into the financial mainstream is a positive and empowering experience.

- PYO meets regularly with each participant to provide guidance as they make progress towards their savings goals.

- LCCU’s noncustodial youth accounts allow PYO students to manage their own accounts and develop financial capability through hands-on experience.

- PYO and LCCU maintain open communication and remain flexible and responsive to the unique needs of each PYO student.

About PYO: As a multi-year, multi-component program in Durham, NC, PYO serves students from 8th grade through four years after high school. PYO students face environmental risk factors that can impact their ability to achieve their educational and vocational potential. PYO partners with the community to provide Durham youth with opportunities to connect, develop, and contribute through mentoring, employment, and educational support.