Big Dreams 2030 Campaign

Our members have big dreams and the talent to match. LCCU’s high-quality loans provide the opportunity they need to build wealth and help our communities flourish.

The Mozqueda family arrived in North Carolina from Mexico in 2004. “LCCU provided us the resources to one day achieve our dreams,” they explain. Shortly after arriving in the US, the Mozqueda’s opened their savings and checking accounts at LCCU. In 2004, they took out a car loan using alternative lines of credit. After establishing credit, they took out three personal loans and, in 2013, they opened LCCU microbusiness savings and checking accounts as sole proprietors of their painting business. In 2016, they took out a five-year adjustable-rate mortgage and purchased their first home.

The family’s three daughters are now LCCU members. The eldest, Ingrid, is a graduate of LCCU’s financial education program and received LCCU’s academic scholarship for four straight years ($10,500 total). She recently graduated from Trinity University and shares: “LCCU has changed my life completely! I am not sure where I would be if I did not have the opportunity, the trust, and resources LCCU has provided for me.” In 2023, the Mozqueda’s middle daughter received the LCCU academic scholarship and started her own academic journey.

$2.5 Billion in Life-Changing Loans by 2030

The results will be transformative!

We Need You to be a Catalytic Change Maker

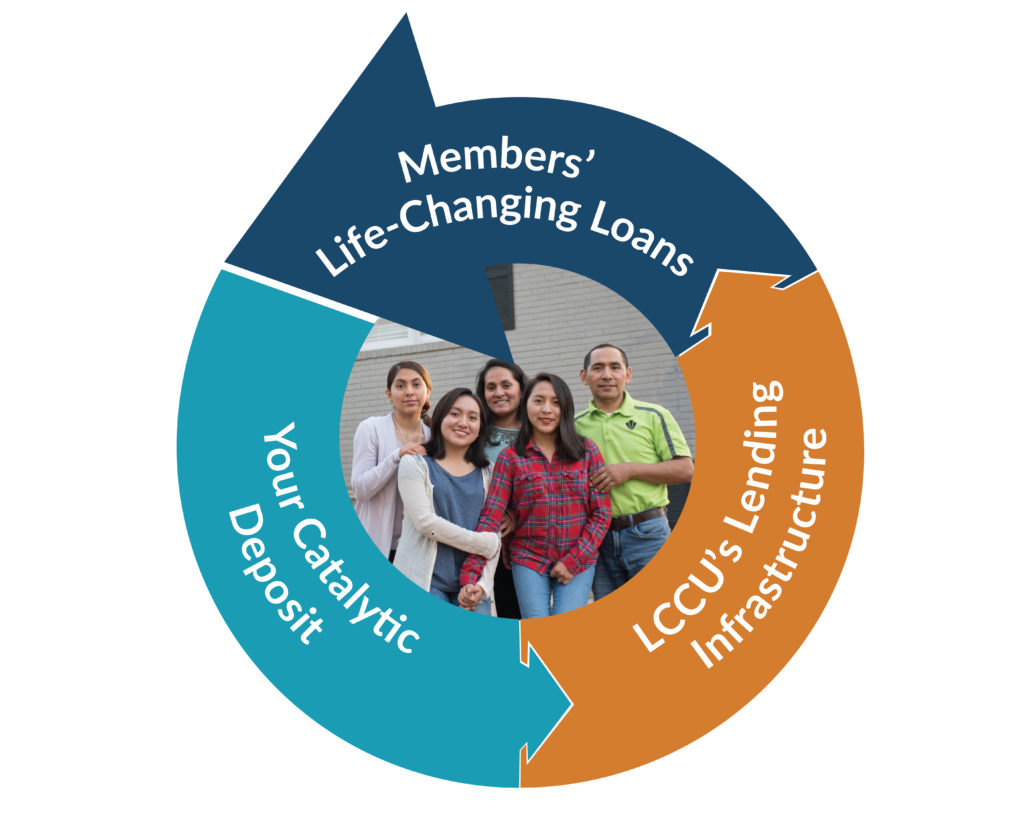

LCCU is calling on all partners and organizations committed to equitable access to economic opportunity to help us raise $250 million in catalytic deposits by 2030 to generate $2.5 billion in life-changing loans.

Make a catalytic deposit today, contact: investments@latinoccu.org.

· The time is now, as the Southeast continues to grow, equitable access to fair and empowering financial products and services is essential to building vibrant communities where families can thrive.

· LCCU is uniquely set up to meet the moment. We are a bilingual, community-focused CDFI with a robust lending infrastructure, a talented and committed staff, and deep reach and trust in communities that traditionally face systemic barriers to economic opportunity.

Access to an LCCU Loan Makes a World of Difference

“Our catalytic deposit provides life-changing loans for LCCU members, often living in underinvested Greensboro neighborhoods, to buy good homes and achieve financial stability. This perfectly supports our mission to invest in community-driven solutions to eliminate health inequities!”

Susan Shumaker, President

Cone Health Foundation

Financial Inclusion

• 135,000+ members from 137 different countries

• $1.9 billion in life-changing loans

• 97% of loans are to Latinos and immigrants

• 65% of members are previously unbanked

• 35% of members established credit for the first time

• 40% of mortgage loans to borrowers with credit scores below 660

Financial Equity

• Bilingual staff and products

• CDFI and MDI certification

• Low-Income CU designation

• Alternative credit accepted

• Award-winning financial education program empowers members to take full advantage of our financial products

Financially Sound

• Deposits federally insured by NCUA

• State regulated

• $1 billion in assets

• 22% Net Worth

• 99.3% repayment rate

Make an Impact Deposit Now: