2000 – First Branch Opened

As part of a grassroots movement, The Support Center, El Centro Hispano, NC State Employees’ CU, and Self-Help CU come together to form LCCU, a safe place for Latinos to save their money, access credit, and build wealth.

2001 – Increased Coverage Across NC

LCCU becomes the fastest growing community development credit union in the country, opening branches in Charlotte, Raleigh, Greensboro, and Fayetteville. The Wall Street Journal says that LCCU “is considered a model in international banking among federal regulators concerned about the so-called unbanked populations here and in Latin America.”

2003 – Recognized for Innovation

LCCU receives the Herb Wegner Award for Outstanding Organization from the National Credit Union Foundation. Since that time, LCCU will receive more than 30 awards recognizing our financial education program and our tailored products and services.

2004 – Introduced Mortgage Lending

LCCU introduces mortgage loans geared towards making home buying more accessible by accepting alternative credit. The mortgage program features a strong educational component and careful underwriting that helps maintain low delinquency and foreclosure rates, even during the financial crisis.

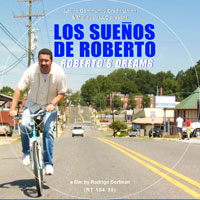

2007 – Expanded Financial Education

LCCU develops the innovative “Dreams” series. These award-winning, feature-length movies are designed to educate members about buying a home and starting a business using an entertaining “telenovela” format. During this time, an online curriculum and educational videos are created to make financial education resources more accessible to members and the larger community.

2009 – Continued Growth and Expansion

With support from local and national partners, LCCU opens additional branches, develops new products, and improves technology, including online account access. New branches are opened in Winston-Salem, Charlotte, Garner, Carrboro, Monroe, as well as a new Virtual Branch.

2015 – Building Capacity and Sustainability

As a sustainable institution, LCCU reaches $200 million in assets. The organization is getting ready for new opportunities.

2020 – The Power of Resilience

LCCU marks two decades of empowering communities with fair and dignified financial services. Amid the challenges of the global pandemic, the credit union’s resilience shines through as assets surpass $594 million.

2022 – Expanding Member Access

To extend reach and deepen impact, LCCU starts making mortgages beyond North Carolina, in South Carolina, Georgia, and Virginia. Additionally, to better serve a growing membership, LCCU opens a new branch in High Point and launches second locations in Greensboro and Durham. The Raleigh and Monroe branches are relocated to larger, more accessible spaces—enhancing convenience and service.

2025 – Poised for Growth

LCCU surpasses $1 billion in assets and reaches $2 billion in total loans to members since its founding in 2000. A comprehensive systems transformation begins, including the launch of a modern, bilingual digital banking platform—expanding access, strengthening security, and deepening LCCU’s commitment to financial opportunity for all. As part of this growth, the Fayetteville branch is relocated to a larger, state-of-the-art facility, enhancing accessibility and member experience in the region.